Our Services

Secure Your Tomorrow with our Expert Guidance

Risk Assessment

Risk assessment is the very first step in the process of financial planning. Assessment of risk of an individual person or an organization is done by the systematic process of risk profiling. A risk profile is an evaluation of an individual or organizations willingness to take risk. A risk profile is important for determinging proper investment asset allocation for a portfolio. We do risk profiling of our customers to so as to guide them with the products as per their risk profile.

Financial Assessment

Child education Assessment

Education inflation is much higher in India compared to retail inflation. It is very important to meet these high raising higher education cost with proper investment vehicle which has potential to offer returns much higher than this inflation. We carefully evaluate this need and make proper plan for your kids higher education so that you should stay ahead financial to support the dream of your child.

Child Marriage Assessment

Marriage is an important milestone in the life of both parent and their children. In Indian culture there is a trandition of making marriage ceromany memorable with rising infletion and new trends it is always challanging for parents to meet marriage expenses. We help you to plan your financials to meet marriage expenses by planning well in advance.

Retirement Assessment

Earlier son used to term as “Budhape ki lathi” and was considered to take care of parents in their old age. With changing time it is now very important for a couple to make provision for their own expenses when they not capable to earn due to old age. With changing time, working life which used to be 35-40 years is reducing and would be 25-30 in future and with modern medical innovations, living life would be 90 to 100 years in future, leaving retired life span of almost 50 to 60 years. We help our customers to plan well for their retired life ensuring a regular source of income during retirement which is capable of meeting and beating inflation.

Goal Based portfolio Building and Management

In our e wealth account, you can map all your financial needs/ goals and link your respective investments to your goals. This ensure your focus on your goal and increases probability of achieving goals. This also helps to keep proper track of your investment with respect to your goals.

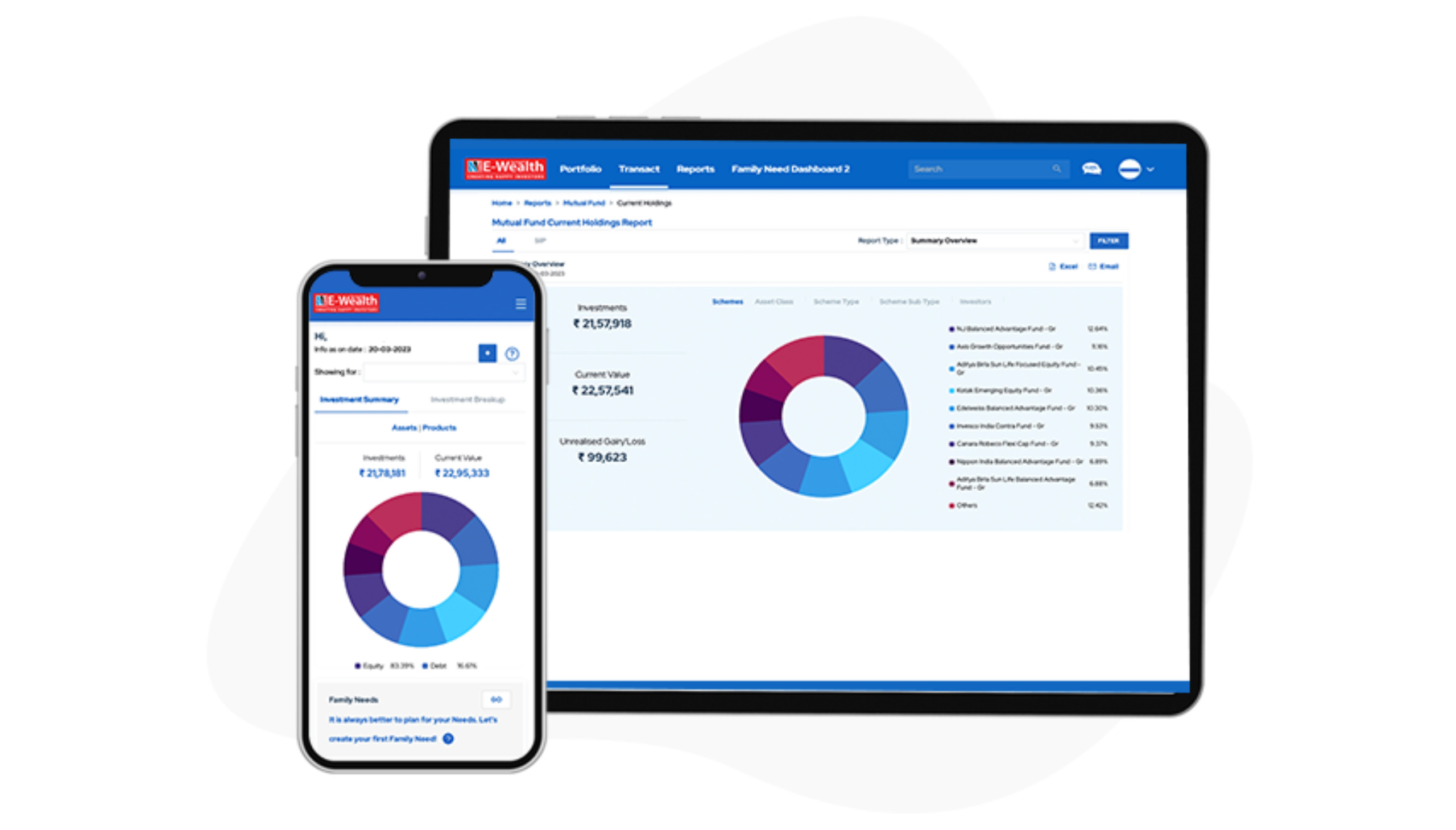

E Wealth Account Service

As a client of our NJ E-Wealth A/c service you can enjoy some big, tangible benefits. You can do hassle, worry and error free transactions in a very easy, time and cost effective manner – any time, any where. We offer easy transaction facility and few very unique services for mutual fund transactions in our NJ E-Wealth A/c service, as given below.

- Fresh Purchase /Additional Purchase /Redemptions /Switch Transactions

- SIP and SWP registration

- NFO – Purchase, Switch and SIP Registration

- Equity Stock SIP registration

- Equity IPOs and Debt IPOs Application

- Comprehensive reports such as transaction report, profit and loss report , performance report etc..

What’s more, we offer multiple modes of doing transactions as listed below…

- Mobile: Transact through application on your mobile

- Online Desk: Transact through online Trading Account Desk

- Phone: Call and transact through your phone

- Offline: Transact through physical instructions

Tax Assessment

Often calculating taxes and paying taxes is cumbersome exercise. We provide annual profit and loss report for investments to minimize tax calculation through investments. We help our customers to minimize the tax outgo by guiding them with proper strategies which helps to minimize the tax

Portfolio Review and Guidance

Regular portfolio review is absolutely necessary to keep track on your financial goals and also investments linked to it. We offer research based portfolio schemes and make necessary changes in asset allocation as and when it is desired during regular reviews. Through our unique portfolio review online tool, get insignts of portfolio performance and status. Now you can also get your existing portfolio reviewed from our online portfolio review tool, and take necessary guidance from us before joining us.

WHY SHOULD YOU GET YOUR MUTUAL FUND PORTFOLIO REVIEWED?

- Optimize Asset Allocation

- Track Financial Need Fulfilment

- Rebalance according to changing circumtaances

Insurance Need Assessment

Sometime it is difficult for individual to assess how much insurance one should take to cover the risks. Incase of life calculating human life value, considering existing liabilities and need for family financial support in absence of key bread earner is necessary to consider for calculating insurance need. We help our customers to calculate the insurance need and also guide them in insurance buying process which insures that they not only get sufficient cover but also the claim gets fulfilled incase of unfortunate situation.

Insurance Claim Assistance Service

We also provide claim assistance service. Many people feel that since cashless claim process is made by insurance companies, all things will be taken care by hospitals. However many time pre-and post hospitalization claim is very challanging process for them. Also before raising claim we guide them what are the important things and documents that they should insist from hospital/ labs. We not only help them to get the claim, but also help them to escalate claim to grivence officer/ ombbudsman incase of the claim is fare and insurance company rejects the claim.